AMFI GOES GLOBAL AND IS BRIDGING CREDIT AND INNOVATION

From Outlook to Opportunity: Know how we are scaling Brazil’s Next Chapter

AmFi is a leading tokenization platform in Brazil focused on private credit. It enables investors to access high-quality credit assets through programmable and compliant tokenized structures. As one of the earliest companies to build legal, technical, and operational frameworks for tokenized debt in Brazil, AmFi plays a central role in advancing the country’s asset tokenization ecosystem.

AmFi’s Global Footprint:

Boosting Best-in-Class Alternative Investments

Access our High Yield Private Credit Opportunities

- Real time Dashboards for investors

- Robust controls and cybersecurity

- Unmatched efficiency through blockchain technology adoption

- Global Access to high-yield, world-class investments

- Pioneer entry to emerging markets with global RWA standards

AmFi BRL High Yield (BRHY)

AmFi USD Fixed Yield (AUFY)

Target and past returns do not guarantee future results. AmFi Platform does not provide investment advice nor recommendations to buy or sell securities or credit opportunities. Independent legal and financial advice is recommended before investing. AmFi and/or its affiliates endeavors to ensure the accuracy and reliability of the information provided but does not guarantee its accuracy or reliability and accepts no liability (whether in tort or contract or otherwise) for any loss or damage arising from inaccuracies or omissions.

Our Reputable Partners & Investors

Numbers in the Spotlight

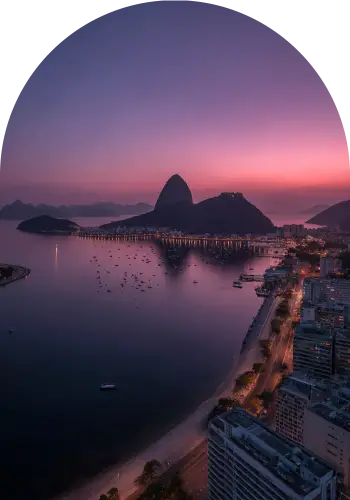

WHY BRAZIL AND WHY NOW?

- Brazil is already deploying groundbraking tokenized credit products

- A bold legacy of innovation makes Brazil uniquely investment-ready

- Capital access is a structural opportunity, not a temporary challenge

- World-class regulators are not observers—they are active catalysts for growth

- Brazil’s dynamic private credit market is set to become a global benchmark